Forex Broker License: Onshore Vs Offshore?

The field of Forex trading is a dynamic one, and for those looking to enter the game as a regulated broker, getting familiar with the regulatory landscape can be a daunting task. A crucial first step is securing a Forex broker license. But with many options available, the question arises: should you opt for an onshore or offshore license?

This article delves into the key distinctions between these two approaches, empowering you to make an informed decision for your Forex brokerage.

Key Takeaways

- Due to stringent regulations, offshore licenses have a strong reputation, which makes them ideal for targeting established markets. However, they come with higher costs and longer application times.

- Offshore licenses offer a faster and more cost-effective route to entry, but some traders may not trust them.

- The ideal choice hinges on your target market, budget, and risk tolerance.

Understanding Forex Broker Licenses

Let’s establish a foundational understanding before diving into the details of onshore and offshore licenses. A Forex broker license authorises a company to facilitate foreign exchange trading for clients. It serves as consumer protection, ensuring onshore and offshore brokers adhere to a set of regulations. These regulations typically cover capital requirements, client fund segregation, and reporting standards.

A Forex broker license is mandatory for firms intending to operate in the foreign exchange market. It ensures that the broker adheres to legal standards and provides a regulated environment for traders. The primary challenge lies in choosing between an onshore or offshore Forex broker license, each offering distinct advantages and disadvantages.

Fast Fact

To obtain one of the European licenses, a broker must have around $100,000- $500,000 of locked capital; NFA requires quite an enormous amount of capital to operate in the US—20 million dollars.

Onshore Forex Broker Licenses

An onshore Forex broker license refers to a license issued by a jurisdiction with stringent regulatory frameworks, such as the United States, the United Kingdom, Australia, etc. These licenses typically require brokers to adhere to strict compliance measures and capital requirements.

Some of the most prominent onshore brokers’ licensing authorities include:

- The Financial Conduct Authority (FCA) in the United Kingdom

- The Cyprus Securities and Exchange Commission (CySEC)

- The Monetary Authority of Singapore (MAS)

Pros of Onshore Licenses

Reputation and Trust → Onshore licenses are synonymous with high regulatory standards, thus enhancing the broker’s credibility in the eyes of traders and investors. It signifies adherence to rigorous standards, granting your brokerage a competitive edge in established markets.

Legal Protection → They offer robust legal protections for brokers and clients, fostering a safe trading environment. Traders are more likely to trust a broker operating under a well-respected regulatory body.

Market Access → Holding an onshore license can provide access to lucrative markets with more regulated and stable trading. Onshore jurisdictions often boast a larger pool of qualified professionals for your brokerage team.

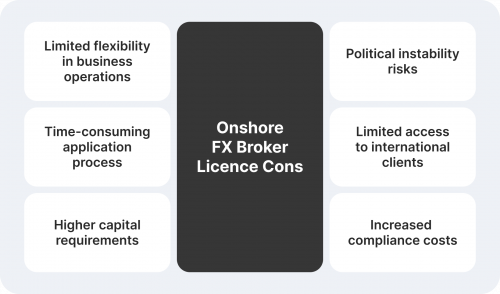

Cons of Onshore Licenses

High Costs → Obtaining and maintaining an onshore Forex broker license can be expensive due to high licensing fees and capital requirements.

Strict Regulations → The stringent compliance and reporting requirements can be troublesome and require significant resources.

Lengthy Application Process → Meeting the stringent requirements can lead to a longer waiting period for license approval.

Geographical Restrictions → An onshore license may limit your ability to target clients in specific regions.

Offshore Forex Broker Licenses

Offshore Forex broker licenses are issued by jurisdictions with more lenient regulatory frameworks, such as Belize, Seychelles, or the British Virgin Islands. These licenses are popular among brokers looking to reduce operational costs and regulatory burdens.

Offshore licenses, offered by jurisdictions outside major financial centres, provide a more streamlined entry point into the Forex brokerage market. These offshore jurisdictions often have less demanding regulations, translating to:

- Faster application times – The licensing process can be completed in a shorter time than onshore options.

- Lower costs – Offshore Forex license typically comes with reduced application and maintenance fees.

- Greater flexibility – Offshore regulators may offer a more comprehensive range of products and relevant financial services.

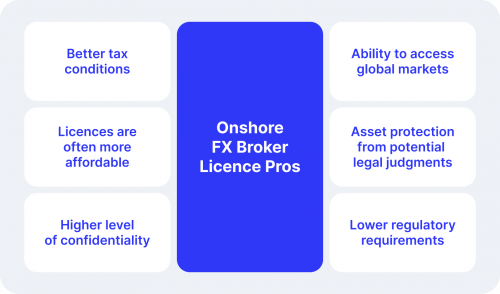

Pros of Offshore Licenses

Cost-Effectiveness → Offshore licenses offer a more budget-friendly option to open a Forex brokerage. They are generally more affordable, with lower initial costs and less stringent capital requirements.

Faster Setup → The expedited application process allows you to launch your Forex company quicker.

Flexibility → They offer greater operational flexibility and reduced bureaucratic hurdles, making it easier for offshore-regulated brokers to adapt to market changes.

Tax Advantages → Many offshore jurisdictions offer favourable tax regimes, reducing the overall tax burden for brokers and offshore companies.

Cons of Offshore Licenses

Perception of Risk → Offshore Forex brokers are often perceived as riskier due to the lack of stringent regulations, which can affect client trust.

Limited Legal Recourse → The legal protections and recourse available in offshore jurisdiction may be less robust, potentially exposing clients to greater risks.

Market Restrictions → Some countries and regions may restrict or limit the activities of offshore brokers, affecting market access and growth opportunities.

Reputational Considerations → Some traders may view offshore Forex licenses with less confidence than established onshore counterparts.

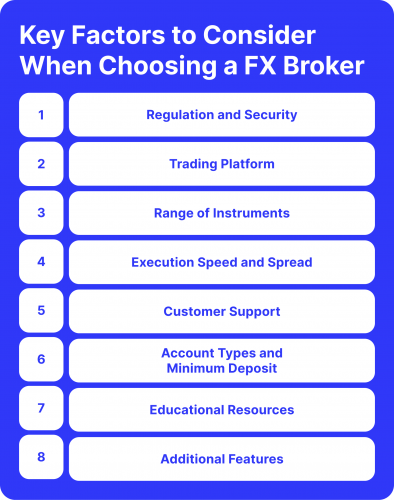

Key Considerations When Choosing a Forex Broker License

The ideal Forex broker license hinges on several factors specific to your business. When deciding between an onshore and offshore Forex broker license, consider the following factors:

Regulatory Environment

The regulatory environment is a critical factor. Onshore licenses come with high regulatory standards that protect investors and enhance the broker’s reputation. For instance, an onshore Forex broker license from the UK requires adherence to the Financial Conduct Authority’s (FCA) stringent guidelines, providing a high level of trust and security for clients. In contrast, offshore licenses offer more relaxed regulatory conditions, which can be advantageous for brokers looking to minimise compliance costs.

Cost and Time

Cost is a significant consideration. Due to extensive compliance checks and regulatory requirements, onshore licenses often involve higher costs and longer processing times. For example, the cost of obtaining a Forex broker license in Australia can be substantial, considering the capital requirements and ongoing regulatory fees.

Offshore licenses, such as those from Belize, are typically faster and less expensive to obtain, making them appealing for new brokers looking to reduce startup costs. Carefully assess the financial implications of each option. Factors include not only initial licensing fees but also ongoing compliance costs.

Forex Business Goals

Your Forex business objectives should guide your choice of license. If you aim to operate in a highly regulated market and attract clients who prioritise safety and regulatory compliance, an onshore Forex broker license may be the better option.

Conversely, an offshore license might be more suitable if you aim to offer flexible trading conditions with lower operational costs. If you plan to expand into new markets in the future, an onshore license might be a more strategic choice.

How to Get a Forex Broker License

The process of obtaining a Forex broker license varies depending on the jurisdiction but generally involves the following steps:

- Decide whether you want an onshore or offshore license. Research the regulatory requirements and market potential of each option.

- Gather necessary documentation, including business plans, financial statements, and compliance procedures.

- Submit your application to the regulatory authority in your chosen jurisdiction, along with the required fees.

- Undergo a compliance review by the regulatory authority to ensure adherence to legal and financial standards.

- Upon approval, you will receive your Forex broker license, allowing you to operate as a Forex brokerage legally.

Conclusion

Obtaining a Forex broker license is a critical step in establishing a legitimate and trustworthy business. By carefully considering the pros and cons of onshore and offshore licenses, alongside the additional factors outlined above, you can make an informed decision that aligns with your specific business goals and target market.

Remember, the ideal license is the one that empowers you to achieve long-term success while upholding the highest standards of client protection.

FAQ

What license must a Forex broker have?

Each brokerage firm must obtain a Forex trading license to work in the international brokerage market. The rules for obtaining a Forex license may vary depending on the laws of the selected country.

What is the Forex broker license for sale?

A Forex trading license is the main requirement for brokerage companies’ legal work, allowing clients to trade on the Forex market or engage in currency trading independently.

How do you conduct a Forex broker license check?

You can ask the broker for their Retail Foreign Exchange Dealer (RFED) number. You can also check with the National Futures Association or the Commodity Futures Trading Commission.